The 2025 Year-End Long Island City Condominium Report

GOODBYE TEENS, HELLO TWENTIES

It is remarkable that 20 years have passed since the first new development condominium came to market in Long Island City. With tens of thousands of new residents, LIC’s growing population density has increased demand for homeownership opportunities. It is more remarkable that even larger changes are ahead as new projects surpass the scale and sophistication of previous developments of the past two decades.

Highlights from the 2025 Year-End Long Island City Condominium Report

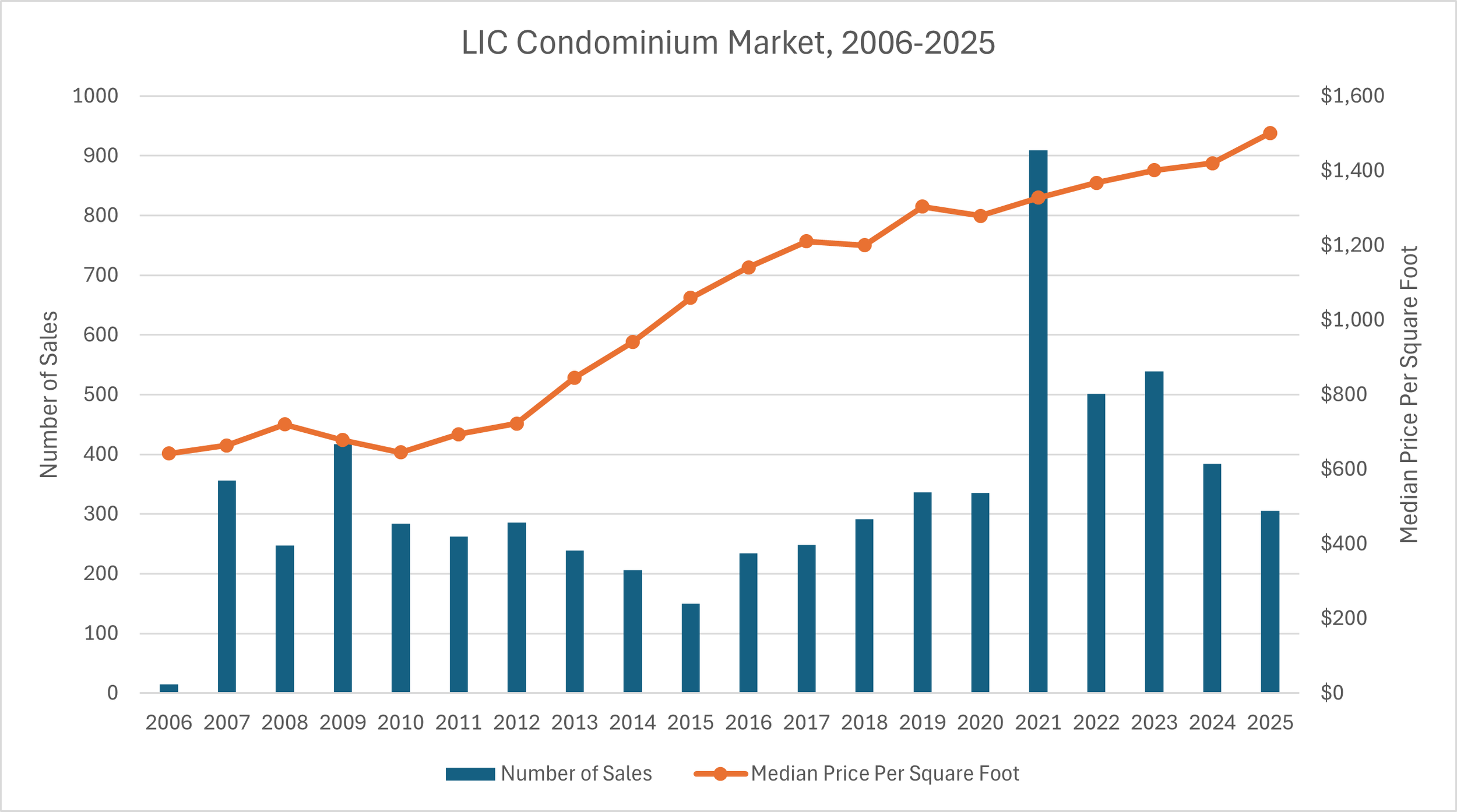

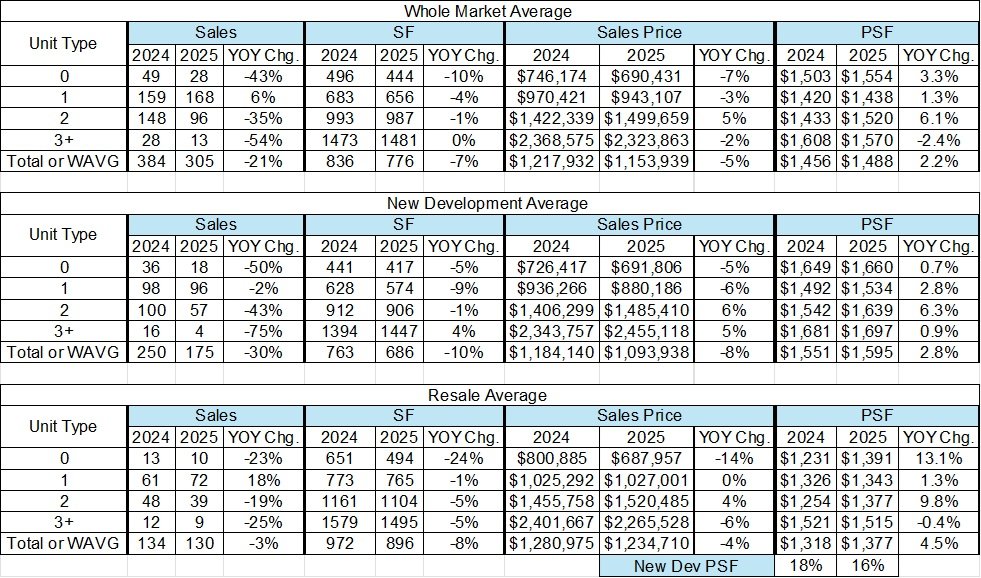

Closed sales declined 21%, from 384 in 2024 to 305 in 2025, largely due to limited inventory; new construction is expected to replenish supply in 2026–2028.

Median price per square foot reached a record high of $1,501 in 2025.

The average price per square foot premium for new development units as compared to resale units was 16% in 2025 (New Dev $1,595 PSF v. Resale $1,377 PSF)

$2M+ sales surged from 16 closings in the 10-year period, 2006–2015, to 174 closings in 2016–2025, including 18 closings in 2025 alone.

Approximately 1/3 of closed units in 2025 were purchased by investors.

Average days on market and average listing discount were somewhat higher in 2025 as compared to 2024 which indicates that buyers have increased negotiation power.

43% of buyers closed on a cash basis without mortgage financing in 2025. By comparison, in 2022, only 19% of buyers paid in cash.

Skyline Tower is the most significant condominium offering in Long Island City in terms of building height (762 feet), total units (802) and dollar volume (> $1 billion).Therefore, we have included a special analysis on the resale market in Skyline Tower in this year's report.

Please request our signature market report with insights and analysis on the Long Island City housing market.

Thank you.

Patrick W. Smith

Licensed RE Broker

MARKET RESEARCH

Our strategic research is independent of any outside influence. We maintain a proprietary database on the Long Island City real estate market. The database includes rental data, condominium sales data and new development pipeline data.

We use our deep market insight to create a competitive advantage for our clients.

We are engaged by real estate developers and other stakeholders to prepare comprehensive studies and recommendations on proposed development sites in Long Island City. We work closely with the development team on planning, design, and product development.

Our custom research services in Long Island City include site specific studies, comparative analysis reports, supply and demand estimates, target market analysis, sensitivity analysis, market segmentation, in-depth pricing studies and labor and demographic forecasts and trends.

Smith’s rigorous quantitative and qualitative market research and innovative strategies helps our clients identify and mitigate unique risks and achieve maximum value.

Thank you for your interest. For more information, please contact us.